Asset Tokenization

Leverage the Modivis engine to cover countless tokenization use cases. Transform your Real-World Assets (RWA) into tokens, ready for seamless integration into blockchain transactions and applications. From real estate to financial products, explore a wide range of tokenization scenarios below.

Asset-Backed Products

Explore a wide range of tokenization use cases powered by the Modivis engine.

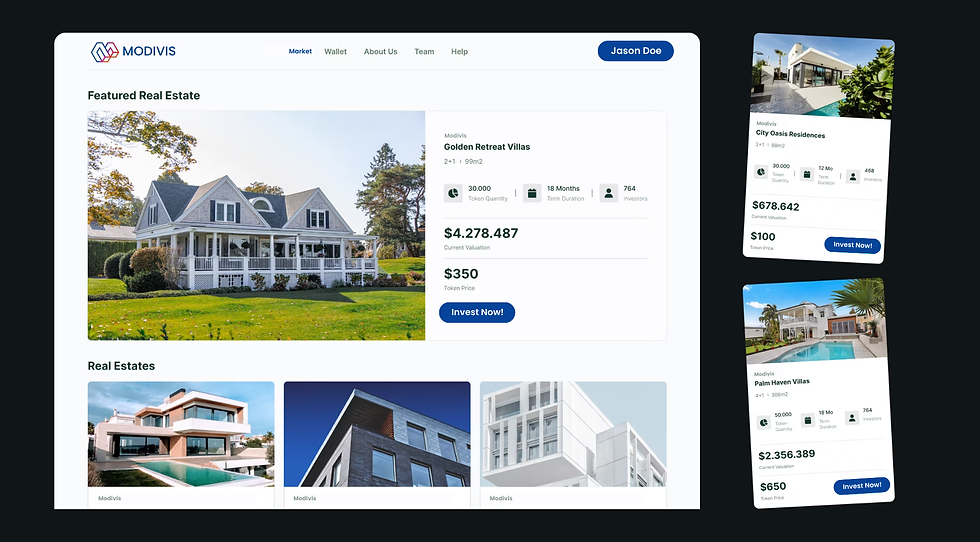

Real Estate

Tokenize assets such as residential, commercial, and agricultural properties for fractionalized investment opportunities.

Ships

Includes maritime vessels such as passenger ships, cargo ships, and yachts used for transportation, trade, or leisure.

Commercial Properties

Covers shopping centers, hotels, and industrial facilities designed for business operations and revenue generation.

Industrial Assets

Comprises factories, warehouses, and logistics centers utilized for production, storage, and distribution across various industries.

Energy Plants

Consists of facilities generating energy from renewable or conventional sources, contributing to global energy needs.

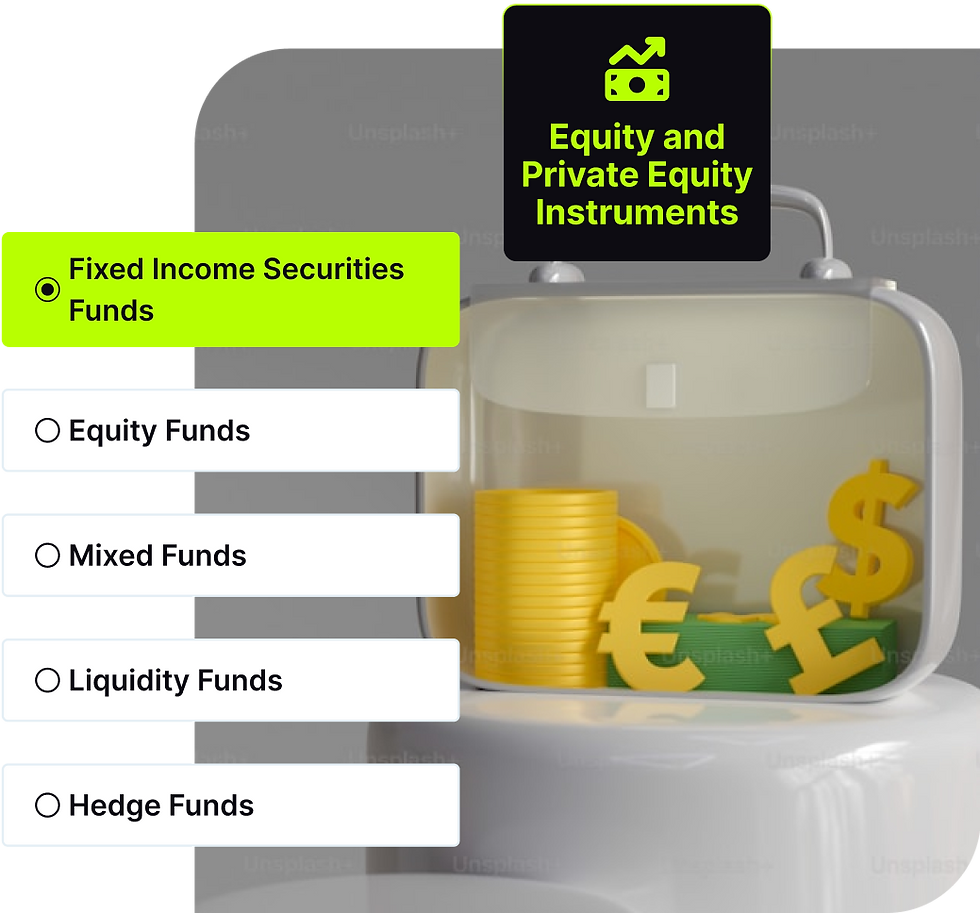

Asset Classification

-

Automatically allowlist and classify each asset based on market metrics, or manually configure classifications according to your business preferences.

-

Customize terms for each class, including loan-to-value ratios, liquidation thresholds, and more.

Borrowing & Lending

-

Enable tokenized or existing crypto assets to be used as collateral for customer borrowing.

-

Lend assets based on your preferred interest return criteria.

Liquidation Mechanism

-

Protect your business during market volatility with liquidation support powered by arbitrage.

-

Operate a liquidation marketplace to offer assets to customers at discounted prices.

Distrubute Income

-

Distribute income from tokenized assets to your investors.

-

Create incentives for purchasing additional tokenized assets.

-

Enable mutual benefits for both your customers and your business.

Offer Tokenized Assets

-

Define the terms of your tokenized offering, as each asset type comes with specific conditions and logic.

-

List the offering on your platform’s launchpad.

-

Enable new investment opportunities for your customers and create a liquidity channel for your business.

Lending Infrastructure

Allow tokenized assets or existing crypto assets to be used as collateral for lending operations. Classify each asset to customize liquidation mechanisms and marketplaces as security measures, ensuring your business remains safe even in volatile markets.

Public Offering Tools

Offer your tokenized Real-World Assets (RWAs) to customers with a customizable value proposition tailored to asset types and preferences, including maturity dates, income distribution, and more. Manage your tokenization value chain seamlessly with a launchpad and a revenue-sharing model.

.png)

.png)